"ABM'Ifying" Your Traditional Inbound Marketing Programs

ABM Tip: Deliver an omni-channel experience with a personalized offer to a targeted audience and see results blossom

One thing I commonly get asked “Isn’t ABM really outbound marketing?” The answer in my experience is that an ABM approach excels when it’s a team effort of both inbound and outbound teams. It is about selecting the right accounts and focusing your sales AND marketing efforts to align to those accounts. To recap our ABM journey at Radius so far, we first proved our success with an ABM pilot and selected our accounts, as well as discussed running ABM programs. But what about running ABM with a traditional inbound demand gen program? You don’t need to change your channels and programs altogether with ABM….just ABM’ify them!

“ABM’ifying” what is a traditionally inbound only channel, webinars, at Radius starts with the strategy. The first real value of ABM is making it more personalized to the accounts you are going after. To do this, we start by analyzing our target accounts and pulling out the attributes our Target A and B accounts have in common to inform our strategy and content creation. In our case, a large number of our target accounts fall in Financial Services.

So, we decided to launch a webinar to help achieve maximum results by matching the largest addressable accounts with custom content.

● Core Audience: Financial Services (20% of our ABM accounts)

● Target Content: Customer Story with a flagship financial services customer

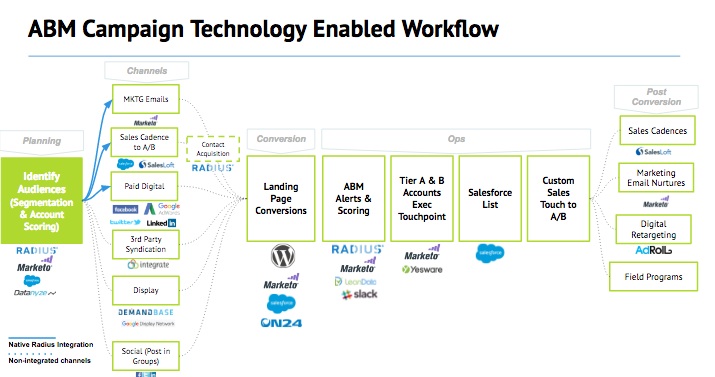

Once we established our core content offering and targeted audience, we were ready to support it with an omnichannel approach to engage in both inbound and outbound tactics resulting in a truly successful ABM program. Below you can see an outline of how we run an ABM campaign throughout our marketing technology stack.

Here are the steps involved:

● Built Our Audience: We identified our audience using both existing account contacts from Marketo and created a segment of net new accounts using Radius, to create a targeted audience to build demand.

● Bespoke Content: Each channel was driving our audience to the the high-value content offering that in our case, is a highly targeted industry-specific webinar to our target persona. The webinar featured a success story in the space of a customer in the same industry.

● Omni-Channel Approach: Next step is to launch our omnichannel efforts to this audience using email, display advertising, and social channels targeting the same custom audience we outlined. In this case we also added an additional more “vintage” channel of direct mail. The team sent a book on financial services marketing reference Radius to key target accounts as well.

● ABM Lead Routing: To ensure “no account is left behind,” our tech stack is structured to ensure that accounts which engage and show interest and intent are bubbled up immediately. This includes a Slack channel alerting us of ABM account actions, Marketo notifications, Demandbase reports, and SFDC lead routing. All of which ensures that if accounts are engaged, both SDRs and our account owners are sure to know.

● High-Touch Follow Up: When a target account registers to the webinar, our ABM program lead will follow up with a custom touch prior to the webinar to say just that “Your company, ABC Financial, was identified as a Tier A account. Let us know if we can address any questions or help prior to the webinar.”

● Nurturing: Post engagement, we continue to engage our target accounts with lead follow ups by retargeting, email nurture, and direct mail to keep our ABM accounts “warm.” The end goal being to keep us top of mind until they are sales cycle ready.

Bottom line is you don’t have to start from square one with your tactics, channels, and tech stack, just “ABM’ify” them!